Trust Foundations: Making Sure Resilience and Dependability

Enhance Your Tradition With Specialist Trust Fund Structure Solutions

In the realm of legacy preparation, the value of establishing a solid foundation can not be overstated. Professional trust foundation options provide a robust framework that can protect your possessions and ensure your wishes are executed precisely as planned. From minimizing tax obligation responsibilities to picking a trustee that can capably handle your events, there are essential factors to consider that require interest. The complexities associated with count on frameworks demand a critical strategy that lines up with your long-lasting goals and worths (trust foundations). As we dig into the subtleties of depend on foundation services, we uncover the crucial elements that can fortify your tradition and supply a long lasting impact for generations ahead.

Advantages of Count On Structure Solutions

Trust fund structure solutions offer a robust framework for protecting assets and making sure long-lasting financial security for individuals and organizations alike. One of the main benefits of count on foundation services is asset protection.

With counts on, people can detail how their properties ought to be managed and dispersed upon their passing. Depends on also supply privacy benefits, as assets held within a depend on are not subject to probate, which is a public and frequently extensive legal procedure.

Types of Depends On for Legacy Planning

When taking into consideration legacy planning, a crucial element entails checking out numerous kinds of lawful instruments developed to maintain and distribute possessions properly. One usual sort of trust fund used in tradition preparation is a revocable living trust. This count on enables individuals to keep control over their properties during their lifetime while making sure a smooth change of these assets to beneficiaries upon their passing away, preventing the probate procedure and offering privacy to the household.

An additional kind is an irrevocable trust fund, which can not be modified or revoked when established. This depend on uses possible tax obligation benefits and shields properties from financial institutions. Philanthropic trusts are also popular for individuals looking to support a cause while maintaining a stream of revenue on their own or their recipients. Unique needs counts on are necessary for individuals with impairments to ensure they receive necessary treatment and support without endangering government advantages.

Comprehending the different kinds of depends on offered for legacy planning is critical in developing a thorough technique that aligns with specific goals and top priorities.

Selecting the Right Trustee

In the realm of legacy preparation, a crucial facet that demands mindful consideration is the option of a proper person to satisfy the critical role of trustee. Selecting the right trustee is a decision that can considerably affect the successful execution of a depend on and the satisfaction of the grantor's wishes. When choosing a trustee, it is vital to focus on top qualities such as dependability, economic acumen, integrity, and a commitment to acting in the ideal interests of the beneficiaries.

Preferably, the chosen trustee should possess a solid understanding of financial matters, can making audio financial investment choices, and have the capacity to browse intricate lawful and tax obligation demands. In addition, effective communication skills, attention to information, and a willingness to act impartially are also crucial attributes click here now for a trustee to possess. It is a good idea to choose someone who is reliable, liable, and efficient in fulfilling the obligations and commitments connected with the function of trustee. By carefully taking into consideration these variables and choosing a trustee who aligns with the worths and goals of the count on, you can assist make sure the long-term success and preservation of your heritage.

Tax Obligation Implications and Benefits

Considering the monetary landscape bordering trust fund structures and estate preparation, it is see here paramount to look into the elaborate realm of tax obligation effects and advantages - trust foundations. When establishing a count on, understanding the tax obligation effects is vital for optimizing the benefits and decreasing possible liabilities. Depends on use various tax obligation advantages depending upon their structure and purpose, such as decreasing inheritance tax, earnings taxes, and present taxes

One significant benefit of particular trust structures is the ability to transfer properties to beneficiaries with reduced tax consequences. Unalterable depends on can get rid of properties from the grantor's estate, potentially decreasing estate tax obligation obligation. Furthermore, some counts on permit income to be dispersed to beneficiaries, who might remain in lower tax brackets, resulting in total tax obligation financial savings for the household.

Nevertheless, it is essential to keep in mind that tax official site laws are intricate and subject to alter, highlighting the need of seeking advice from with tax professionals and estate preparation experts to make certain compliance and make best use of the tax obligation benefits of depend on foundations. Effectively navigating the tax obligation implications of depends on can result in considerable savings and an extra efficient transfer of riches to future generations.

Actions to Establishing a Trust Fund

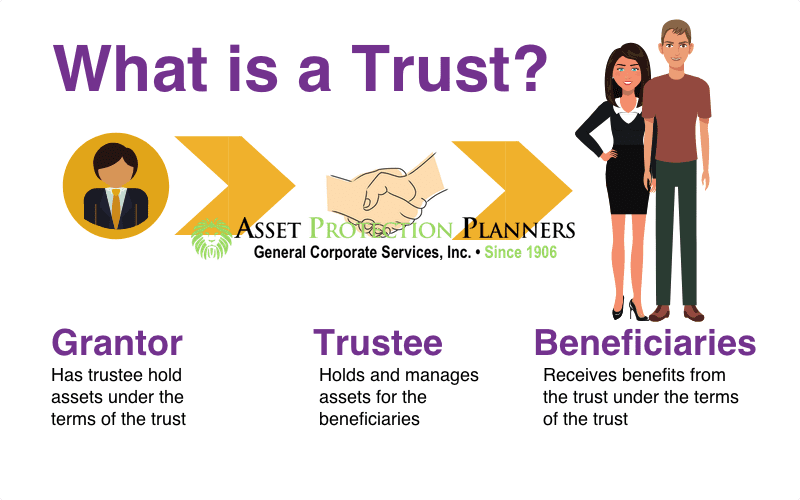

To establish a depend on successfully, meticulous interest to information and adherence to legal procedures are essential. The very first step in establishing a count on is to clearly define the objective of the trust and the possessions that will certainly be consisted of. This involves identifying the beneficiaries that will certainly gain from the count on and selecting a reliable trustee to manage the assets. Next, it is vital to pick the kind of trust that best aligns with your goals, whether it be a revocable count on, irreversible depend on, or living trust fund.

Final Thought

To conclude, developing a count on structure can offer countless benefits for legacy preparation, consisting of asset defense, control over distribution, and tax obligation benefits. By choosing the ideal type of depend on and trustee, people can guard their assets and ensure their desires are executed according to their desires. Recognizing the tax implications and taking the needed actions to establish a trust fund can aid strengthen your tradition for future generations.